Build a budget, stay on track and plan for the future with Security Federal Bank.

PFM - Insights

Looking for a Smarter Way to Manage Your Money?

Introducing Insights - a more intuitive digital banking tool.

It’s easier than ever to get insights into your finances with Security Federal Bank. You can build personal budgets, manage your cash flow and set goals for the future — all in one intuitive interface. It’s one more way Security Federal Bank helps you achieve your financial goals.

Accessing Insights Through the SFB Mobile App

- Sign into the Security Federal Bank App

- Click the Menu button (three lines) in the top left corner

- Click Insights

Accessing Insights Through Online Banking

- Sign into Online Banking

- Click on an account

- Click the Insights button on the right of your screen

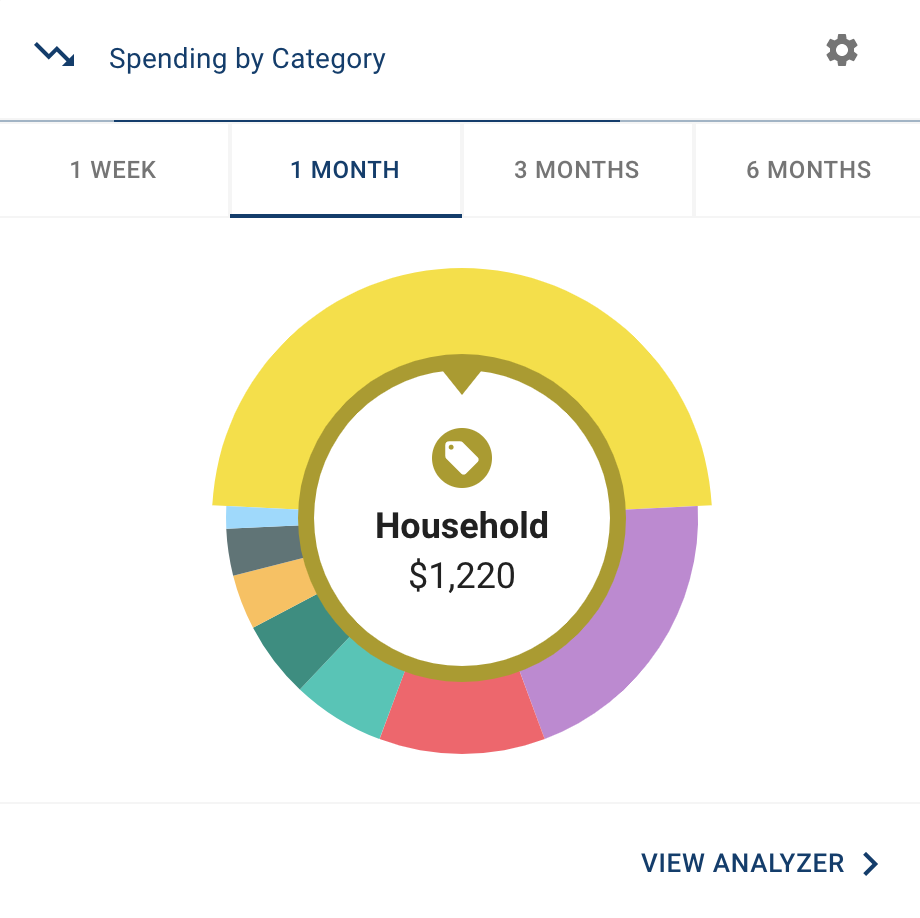

See Your Spending on the Dashboard

The dashboard displays your top spending category each month.

Step 1: Click different parts of the wheel to see your spending breakdown. Transactions are sorted automatically into these categories with 'tags.'

Step 2: To personalize your categories, or split the transaction between tags, click on a transaction and edit the tag.

Step 3: When you select a transaction from the dashboard you can also change the name of the transaction, create a budget or add a recurring transaction to your Cashflow Calendar.

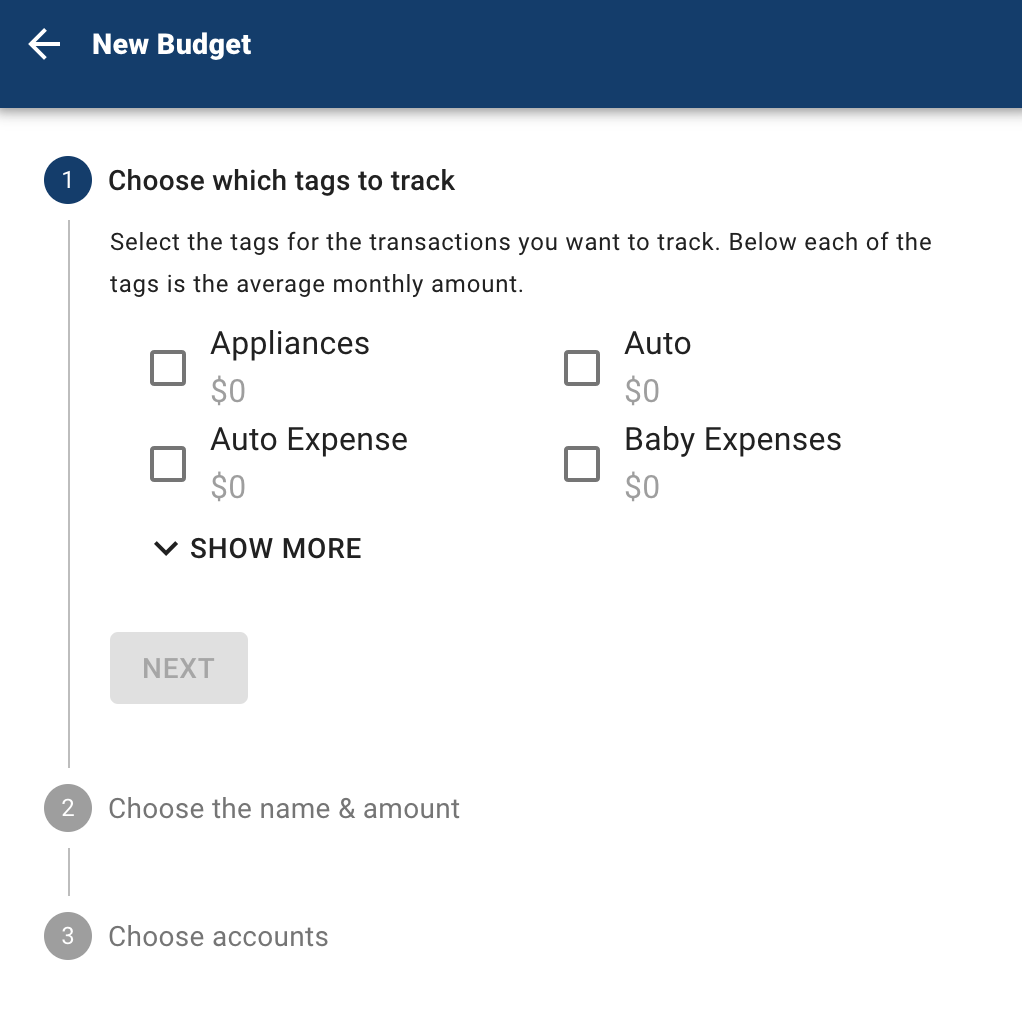

Set Spending Targets

Insights gives you valuable insights based on your spending habits. These insights will help you build a more accurate budget.

Step 1: Click different parts of the wheel to see your spending breakdown. Transactions are sorted automatically into these categories with 'tags.'

Step 2: To personalize your categories, or split the transaction between tags, click on a transaction and edit the tag.

Step 3: When you select a transaction from the dashboard you can also change the name of the transaction, create a budget or add a recurring transaction to your Cashflow Calendar.

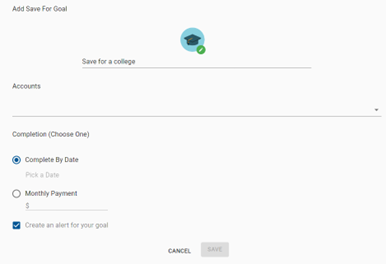

Create Savings Goals

You can set goals to help you plan ahead - like saving for a vacation or paying off credit card debt. Once that's done your Goal Summary will show you the completion date and the amount you need to save each month.

Step 1: Navigate to the "Goals" section and select "Add Goal."

Step 2: Select your desired pay off or savings goal.

Step 3: Fill out the name of the goal, which accounts you'll use and your target date.

Step 4: Click "Save." Your goals will automatically update based on your progress and day-to-day account balance.

Integrate Other Accounts

You can sync accounts from other financial institutions to get a full picture of your finances.

Step 1: Navigate to the "Accounts" section.

Step 2: Click the plus sign to "Add Linked Account."

Step 3: Select an institution or use the search to find your institution. Follow the prompts to add your institution.

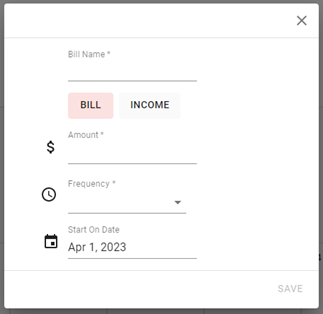

Track Your Cash Flow

See down to the penny how much money have coming in - and going out - each month. Simply log your income and bills into the cash flow calendar. Here's how:

Step 1: Navigate to the "Cashflow" section.

Step 2: Click the plus sign to add your income and bills.

Step 3: Put in your monthly income and expense amounts to calculate your monthly cash flow.

Sign up to receive the Security Federal Bank newsletters

* indicates required fields

Thank you for signing up!

Someone from our office will reach out to you soon, if necessary.

.png)

.png)